Understanding Market Trends

Entering the third summer of the COVID-19 pandemic, floral shops can continue to seize on the popularity of gardening hobbyists and at-home flower lovers to capture new business by educating customers and tweaking merchandising plans.

By focusing on teaching shoppers to notice hardiness and other quality features of plants and flowers, floral retailers can fine-tune how they are engaging with their customer base, while inviting consumers to pick up supplemental tools and products. These tips, marketing guidance, and insights into the perceived value of nursery plants in the U.S. and Canada are outlined in a three-part Floral Marketing Fund (FMF) plant purchasing study conducted by researchers at the Vineland Research and Innovation Centre and the University of Guelph. While the study focuses primarily on nursery plants, there are still many impactful, broad consumer insights that can help all floral shops understand purchasing behaviors and capitalize on them.

The research, consisting of interviews and surveys of garden center customers, provides a comprehensive report on plant purchasing behaviors and reveals several opportunities to increase sales. Because part of the study was conducted prior to the pandemic and more was completed during the pandemic, it also offers valuable information on the adaptations required to meet pandemic-driven gardening needs. The study included 44 one-on-one interviews with customers and store staff, an online survey of 678 adults 18 and older, and another sample of shopper intercept interviews.

The research, consisting of interviews and surveys of garden center customers, provides a comprehensive report on plant purchasing behaviors and reveals several opportunities to increase sales. Because part of the study was conducted prior to the pandemic and more was completed during the pandemic, it also offers valuable information on the adaptations required to meet pandemic-driven gardening needs. The study included 44 one-on-one interviews with customers and store staff, an online survey of 678 adults 18 and older, and another sample of shopper intercept interviews.

“We want to answer the question of, how do we keep this high-level of engagement with consumers as we come out of the pandemic,” said Dr. Amy Bowen of the Vineland Research and Innovation Centre, one of the study’s researchers. “Garden centers and retailers have had a captive audience. So, now, how do you keep them engaged?”

Education, broadening gardening hobbies, and closely following inventory are three of the answers revealed in the study.

Educational opportunities

With the well-documented spike in garden and plant sales during the early part of the pandemic, Bowen said the teams’ research revealed consumers are looking for recommendations and expert help.

“They want to know what plants to purchase for their needs and what factors to consider,” she said.

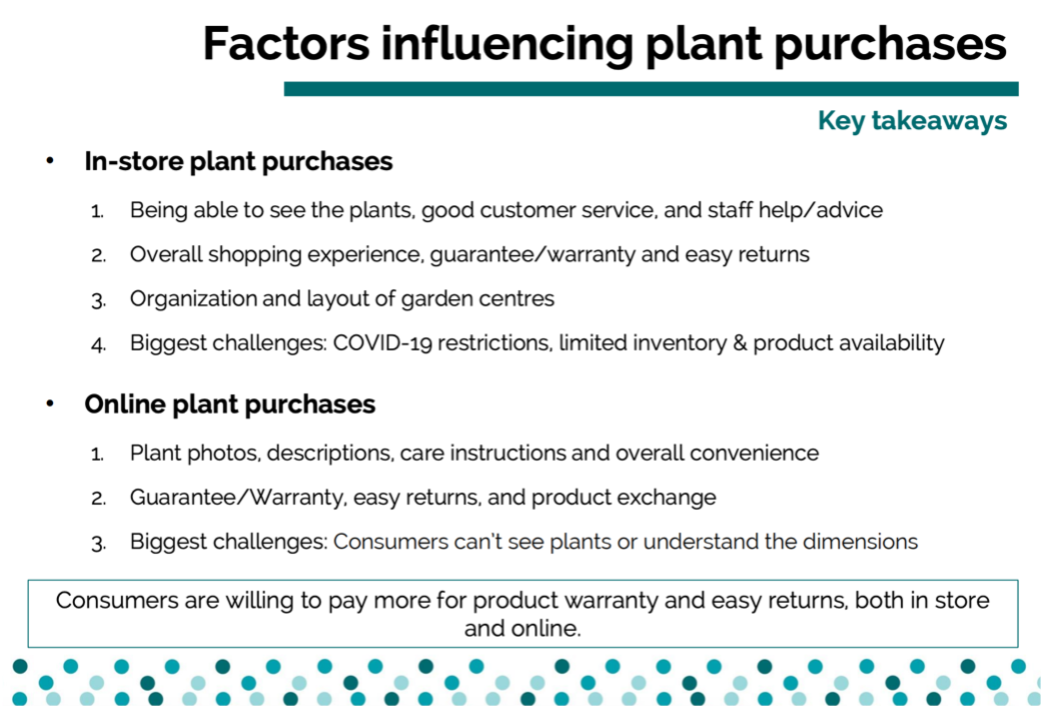

Nudging consumers to understand and notice hardiness and other quality features could aid in not only saving on warranty fulfillments but also help drive premium pricing for higher quality products allowing for greater profit margins, Bowen said. For florists, educating the consumers on vase life and care could show the same level of expertise that the consumer is looking for.

Nudging consumers to understand and notice hardiness and other quality features could aid in not only saving on warranty fulfillments but also help drive premium pricing for higher quality products allowing for greater profit margins, Bowen said. For florists, educating the consumers on vase life and care could show the same level of expertise that the consumer is looking for.

Thinking about educational workshops that drive customers to buy needed supplies is another growth area that both garden centers and retailers could consider, as the research clearly revealed a high trust in the knowledge of the staff. Workshops could include things such as how to build a summer garden, or how to make a fall wreath, Bowen suggested.

Nurturing the hobbyist

The online survey showed that consumers were enticed by large inventories, deals, offers, and promotions. Despite most garden center shoppers not being price sensitive – only 30 percent indicated they engage in in-store price comparison – promotions are still valuable in attracting customers.

Additionally, many gardeners began by tackling outdoor gardening beds or potted plants for window boxes and decks, Bowen said, leaving garden centers and floral retailers with a significant opportunity to draw customer attention indoors. “By increasing their plant habits indoors, there is room to sell many more indoor plants,” she said.

Monitoring inventory trends

Many plant purchasers are making repeat purchases, coming back to the same known product. The pandemic changed shopping habits. By paying attention to what those plants or flowers are, floral shops are in a better position to not only stock the best-selling plants in the best-selling size but to implement premium pricing.

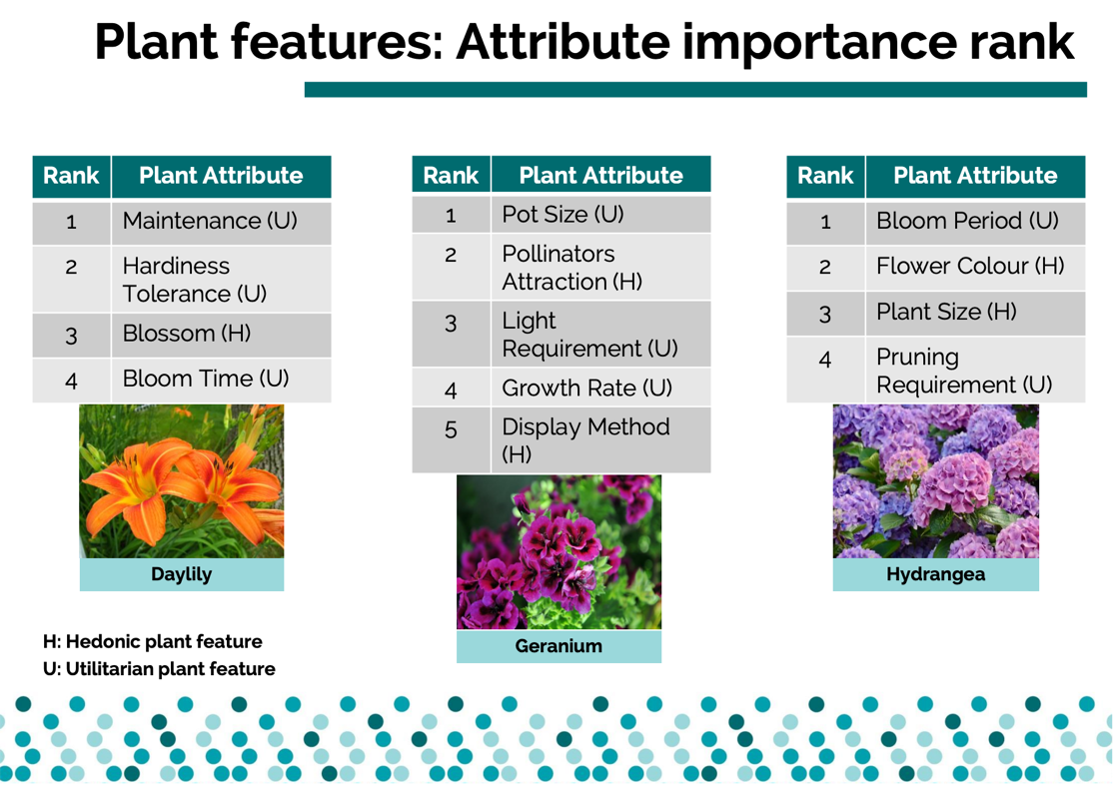

The study showcased that most shoppers are looking for easy-to-grow, low-maintenance plants. And while most are not price-sensitive, they are sensitive to finding a specific color. Finally, many are interested in attracting pollinators to their outdoor gardens.

While the study revealed preferences for buyers in Canada and US, Bowen said it’s important for each retailer and garden center to know what those elements are for their consumer base.

The full study and more information on plant purchasing is available for download here.

The full study and more information on plant purchasing is available for download here.

Interested in becoming a sponsor or supporter? Consider making a contribution to FMF to help us continue to provide insights like this to the industry.

By Sarah Sampson